Important Updates to Service Tax Policies

Here are the key takeaways from the STPs dated 17th October, but applicable with effect from 1st July 2025.

- For service tax exemption in respect of non-reviewable contracts, the timeline for stamping is extended to cover contracts stamped by the Inland Revenue Board of Malaysia (IRBM/LHDN) before 31st December 2025 (i.e. by 30th December), provided the contract is signed before 1st July 2025 and other conditions are met. The timeline for Variation Order (VO) and Extension of Time (EoT) has been aligned to these dates as well. Exemption for non-reviewable contract is available only in respect of the period 1st July 2025 to 30th June 2026.

- Construction works in relation to residential buildings within a mixed development project is granted service tax exemption, subject to meeting of specified conditions. Apportionment formula applies in relation to construction cost for shared public facilities.

- Business-to-business (B2B) exemption for consultancy services under a design and build construction contract when such services are provided under a single contract that covers the entire scope of work supplied by the main contractor to the developer or landowner.

- Refund claim is permitted in respect of service tax for the months of July and August 2025 with respect to B2B exemption.

- Clarification that intragroup relief (in respect of transactions within a group of companies) applies to imported services in respect of rental and lease of movable and immovable property.

- Refund claim is permitted in respect of service tax for the months of July and August 2025 with respect to B2B exemption.

- Exemption for education services for children and dependents of foreign diplomats, subject to the diplomat obtaining confirmation letter from the Ministry of Foreign Affairs.

- Exemption on education fees or service charges that are fully sponsored by educational institutions, higher learning institutions, companies, foundations, or other organizations.

- Following a prior announcement, the ‘blanket exemption’ for financial services has expired on 30th September 2025.

- Scope of B2B exemption is expanded to include reinsurance services provided in relation to non-taxable services i.e., medical insurance, medical takaful, life insurance, and family takaful services. This exemption may be effective prospectively from 17th October 2025. This exemption on reinsurance is aimed at avoiding ‘hidden service tax’ cost in the premium of the said insurance policies which have been exempt from service tax at all material times.

Although the documents are recently published and dated 17th October 2025, the effective date for most of the exemptions is 1st July 2025. Hence, businesses have to consider issuing credit notes to customers where appropriate, with consequential impact on SST-02 reporting. While timely action is needed for stakeholder management, it is also important for businesses to carry out an impact assessment prior to any action with this regard.

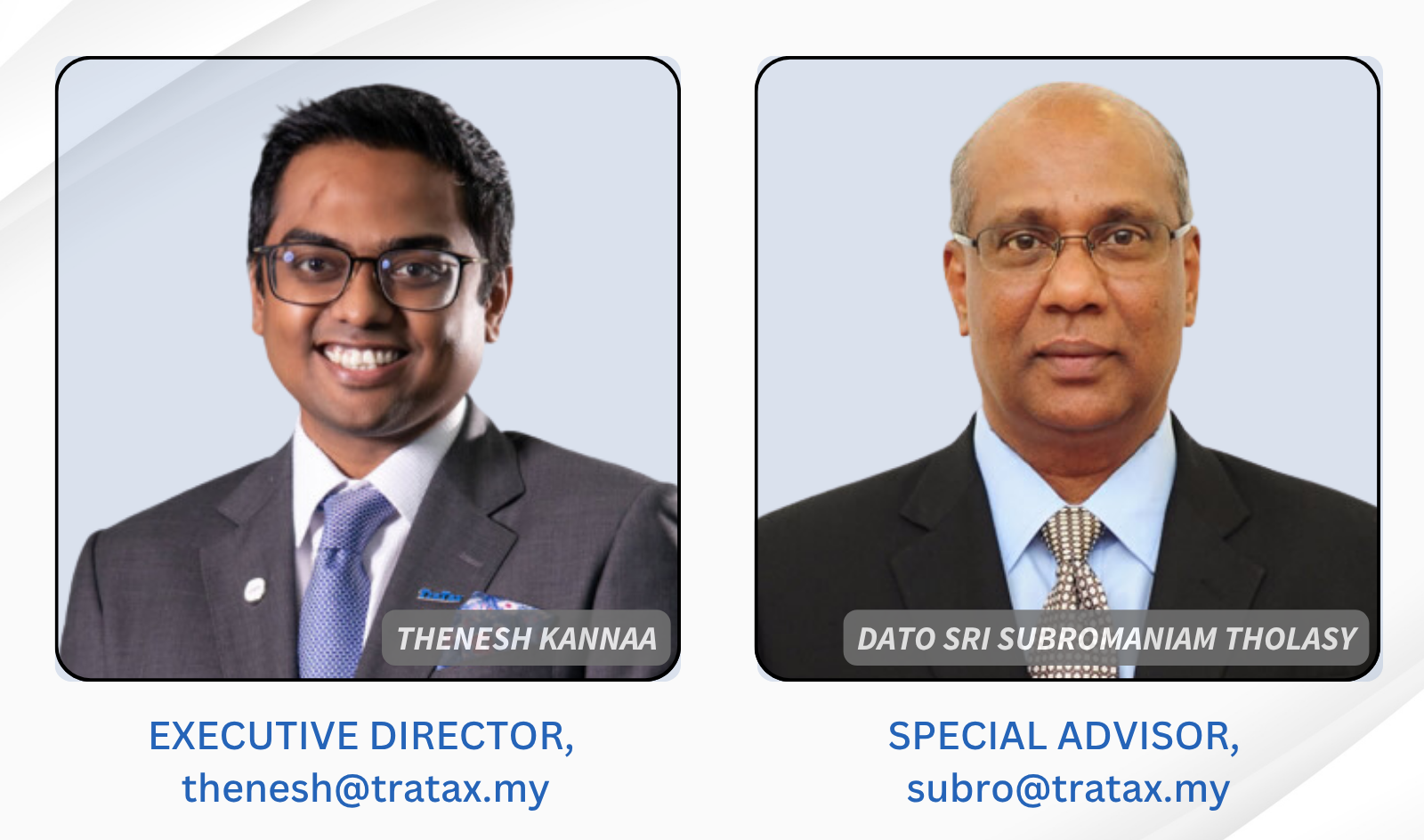

The contents of this write-up are of generic nature. Strictly no liability assumed. For case-specific consultancy and professional support, do reach out to your contact point at TRATAX or email thenesh@tratax.my